When we're conducting interviews at Matter, we start every day by reminding ourselves of common biases to avoid. One of those is pattern matching: using what amounts to stereotyping, rather than data and insights on the specific founder you're evaluating, to make decisions. For example, investing in a founder because they remind you of Mark Zuckerberg is pattern matching.

Similarly, evaluating one company based on another's performance - rather than the characteristics of the business on its own merits - is harmful. Just because one company failed, that doesn't necessarily mean that another, superficially similar company will too. It might, but the devil is in the detail. There could have been a hundred reasons, like market timing or team dynamics, that led to the startup's failure.

Which is something I'm struggling with as I think about the emerging marketplace for decentralized apps.

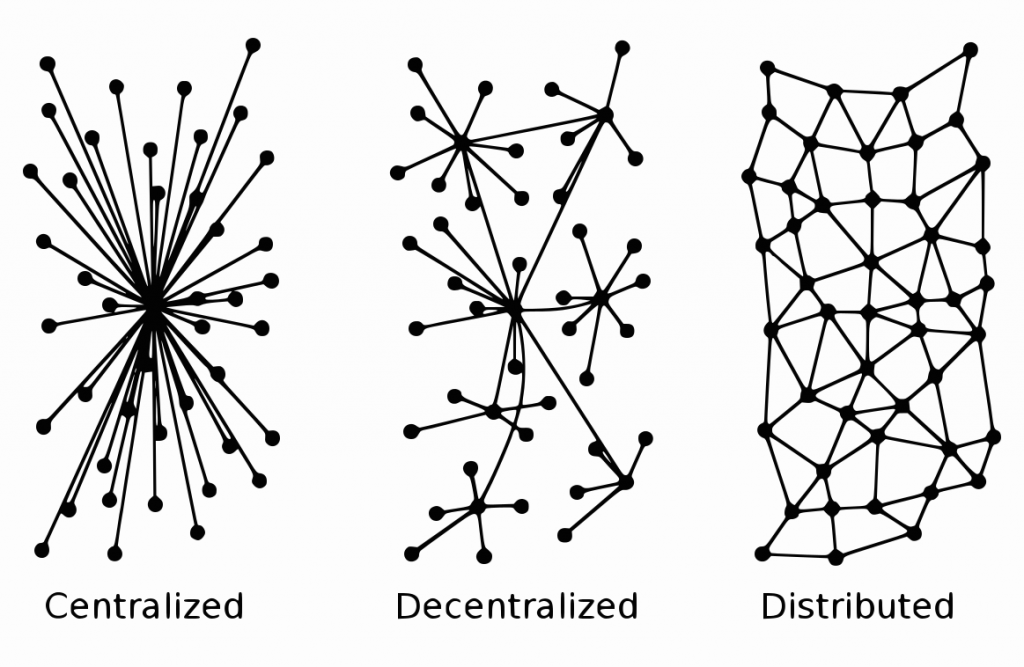

For most of my career, before I became an investor, I was concerned with overcentralization of the internet. It seemed harmful to me - and a community of others - that most of our private information and highly personal communications were being stored and processed by a very small number of for-profit corporations. It also seemed counter to the vision of the web as a platform that nobody owned and anybody could contribute to.

In 2004, this was not a mainstream opinion to hold. So while I signed the Bill of Rights for the Social Web, built an open source social networking platform that could be self-hosted, and advocated for user-centered development for years, my efforts were met with questions like, "why wouldn't I use Facebook?" and comments like, "I've got nothing to hide." Impressive decentralized efforts like the DiSo Project and StatusNet never quite found a solid footing, although both led to advances in the space that are still being used today.

This ongoing community continues to meet, including at the upcoming Decentralized Web Summit, but it's uncanny to see the same arguments being used by a new generation of decentralized developers - and investors. Take this statement by Joel Monegro at Union Square Ventures:

The combination of shared open data with an incentive system that prevents “winner-take-all” markets changes the game at the application layer and creates an entire new category of companies with fundamentally different business models at the protocol layer. Many of the established rules about building businesses and investing in innovation don't apply to this new model and today we probably have more questions than answers.

Not only is this kind of institutional, utopian talk about decentralization a departure from the conversations we'd seen for the previous decade, it flies in the face of how many people think about venture capital, which has been tightly associated with "winner-take-all" markets.

The language and arguments are so similar that I have to fight to disassociate them with earlier attempts at decentralization. The real questions are: What makes blockchain different? Why is now a better time than ten years ago? What will these new technologies enable? And who are they for?

Today's decentralization has to be evaluated on its own merits, and not through the lens of the things that were built and tried previously. Hypertext existed before HTML, but the web was the thing that made it mainstream. I'm doing my best to drop my cynicism and better understand what the potential for these new technologies are - and as I do so, and squint beyond the greedy coin speculation and the ugly Libertarian ideals, the more I see to like. The web is a good analogy, because the utopian ideals that built that platform are present here too. And while web business models defaulted to monopoly, we're seeing something very different emerge here.

Share this post

Share this post

I’m writing about the intersection of the internet, media, and society. Sign up to my newsletter to receive every post and a weekly digest of the most important stories from around the web.