Grateful to not have had any side effects from my covid booster or flu shot this week, and for the miraculous fact that these protections exist at all. Thank you, science; thank you, scientists.

"If these people show up to the polls with the intention of disrupting voting from taking place, then I can't imagine a worse threat to democracy than that.” #Democracy

[Link]

·

Links

·

JP Morgan cancelled Kanye West’s bank accounts following his anti-semitic remarks today.

Over the last few years, a raft of “free speech” social networks have emerged as an alternative to the content policies enacted by companies like Twitter. They take very public anti “cancel culture” stances. But what does that really mean?

Using observer accounts, I took a peek at each of the main ones to see how this particular piece of news went down. Here I will issue a content warning: posts on these sites, including those run by mainstream political operators, are extremely disturbing.

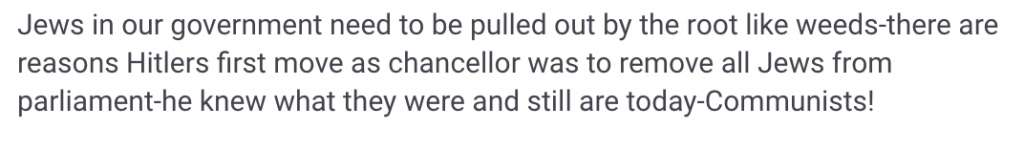

Truth Social is owned by the Trump Media and Technology Group, which in turn is chaired by former President Donald Trump. There, an account with over 50,000 followers (10% of its Daily Active Users) states:

Truth Social has around 2 million users.

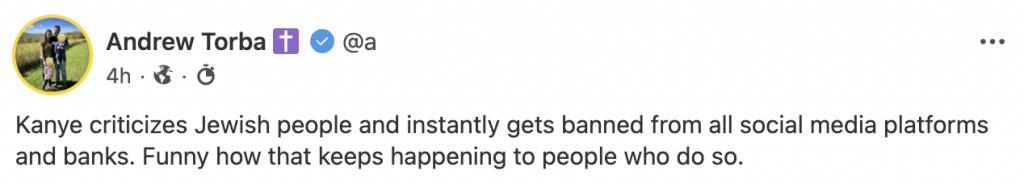

Gab was founded in 2016 as the first right-wing alternative social network. The founder (who has 3.7 million followers) writes:

In response to a post that asks "who runs JP Morgan Chase?" hundreds of users respond with some variation of "the Jews".

Gab has around 4 million users.

Minds was founded in 2011 and originally built on top of Elgg, the open source social networking framework I co-founded. While it was originally created as an alternative to surveillance capitalism, its anti-banning stance caused it to provide a home to white supremacists banned from mainstream networks in the wake of the January 6 insurrection. (Indeed, Trump had invited its founders to the White House alongside the founders of the networks listed above in 2019.)

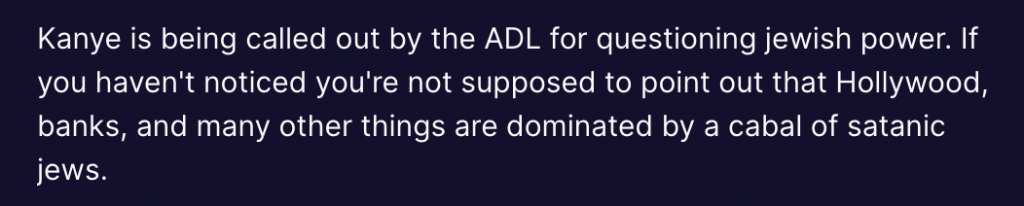

Over there, a popular post states:

Minds has over two million users.

GETTR is another conservative Twitter clone, this time founded by a former Trump aide. Here the anti-semitism is less overt, although a few comments from fringe accounts did talk about “the satanic Jews”, which was a trope on the other networks.

GETTR also has around 4 million users.

Parler, which also emerged during the Trump era, is hopelessly unusable. I couldn’t figure out how to search for content on it, when it even managed to log me in.

Parler claims to have a million users, but I don't know how.

It’s not a partisan statement to say that I find these comments to be utterly chilling both in terms of their content and their effective endorsement by large-scale backers that include the former President of the United States.

I’m also deeply unhappy with how my open source code was used to build Minds. I don’t believe its founders to be anti-semites, but I do think that tolerance of this kind of hatred is not anything approaching the virtue that they think it is. While these sorts of hateful ideas can certainly be countered by better ones, it’s also certainly true that alternative social networking sites have been used to plan undemocratic insurrections and hate crimes that led to real harm.

Mainstream social networks, particularly Facebook, are not off the hook here: banning anti-semitism does not absolve you of complicity in genocide elsewhere. Twitter also has its fair share of discoverable posts that espouse anti-semitic tropes. But these other networks are remarkable for their concentration: whereas these ideas are a tiny fringe on Facebook and Twitter, they’re how these other networks support themselves. You go to an alt network because you’ve been banned - or you’re worried you will be banned - from a traditional one. This concentration of extremists is why much of the insurrection was able to be openly organized on networks like Gab.

The Southern Poverty Law Center noted as such in its The Year in Hate & Extremism Report 2021:

Hate groups and other extremists do not solely rely on mainstream social media platforms to spread their message — they are increasingly using “alt-tech” platforms that are often advertised as “free speech” alternatives to places like Twitter and Facebook. On these platforms, users don’t have to worry about content moderation. These include video platforms like Bitchute and Odysee and social media sites like Gab.

And there does seem to be a growing, violent movement lurking here. Incidents of antisemitism in America hit an all-time high in 2021. I’m certain that this is in no small part because overtly racist town squares have become easier than ever to be a part of. These networks have millions of users, are growing, encourage real hate crime, and have ringing endorsements from people who have held the highest office in the land. We overlook them as sideshows at our peril.

·

Posts

·

“Those 402 [police] stops also yielded more than $1 million in cash and money orders from a total of 25 passengers” even though drugs were not found on them. Absolutely vile. #Democracy

[Link]

·

Links

·

My baby smiling in recognition when I go to say hello is the best part of each and every day.

This is a great time to build something from scratch. But if you're building, do it right: by distributing equity to your community, building with ethics and empathy, and doing it to build value for everyone for a long time.

For a new project, I’d love to understand how you read fiction. In particular, I’d love to know what your favorite topics are, which books you particularly love, and how you discover new books to read.

So I put together a short, anonymous survey. It shouldn’t take more than a few minutes to fill out, and it would really help me. All questions are completely optional, and it would be useful to me even if you just filled out one.

I’ll follow up with results in a future post. Thank you!

·

Posts

·

An epic corporate security breach using drones. The stuff of movies. #Technology

[Link]

·

Links

·

It shouldn't be considered a partisan statement to say that we need to keep anyone who espouses white supremacist replacement theory rhetoric should be kept far, far away from power.

“For years now, researchers have understood that wildfire smoke, and the noxious gases and soot particles it carries, isn’t merely an unpleasant experience that forces people to shut windows and herd children indoors. It’s a significant health hazard that not only triggers asthma and breathing problems, but can harm immune systems for years.” #Health

[Link]

·

Links

·

“The startup, called GloriFi, initially aimed to launch with bank accounts, credit cards, mortgages and insurance, while touting what it called pro-America values such as capitalism, family, law enforcement and the freedom to “celebrate your love of God and country.” Within months, the investors’ money was nearly gone, and GloriFi was on the verge of bankruptcy.” #Business

[Link]

·

Links

·

Happy Indigenous Peoples’ Day to everyone in the US. Hooray for celebrating the people who really discovered and settled this continent.

“MacAskill begs us to ask questions like: Do you care about the specter of climate catastrophe? Definitely. World War III complete with nuclear annihilation? Yikes, yeah. How about population stagnation and potential collapse because rich people stopped having enough babies? Wait, huh? What do you think about lowering the probability of complete human extinction by .0001% at the expense of allowing 100 million people to die in genocidal neglect?” #Society

[Link]

·

Links

·

“Session replay tools have been a privacy concern due to their indiscriminate capturing of data, sometimes poor security, and failures to get user consent to track and store this data, not to mention having analysts going over your every move to see how they can optimize their webpages and boost sales.” #Technology

[Link]

·

Links

·

I’ll follow Doctor Who anywhere - I’ve been a fan since I was five years old - but the trailer for the BBC Centennial episode left me cold, even despite the welcomed presence of Ace and Tegan.

It’s had some criticism, and there were some clunkers (hello, Kerblam), but I’ve broadly enjoyed this era: an optimistic Doctor, a renewed focus on inclusion and kindness, a family-friendliness that doubtless brought in new kids. Season twelve in particular was a lot of fun, and I enjoyed the mystery that The Timeless Children brought back to the character’s origins. The execution could sometimes have been tighter, but it was all good. I’ll follow this show anywhere.

What I wish, though, is that they’d embrace some smaller stories. Classic Who was often structured like a mystery novel: something weird was happening, and the Doctor would have to get to the bottom of what was causing it. Often there were multiple contenders, like potential murderers in an Agatha Christie or Sherlock Holmes story. The survival of the world didn’t need to be at stake; it could be creepy and self-contained in its own right. The stories could still talk about big topics, but they didn’t need to be bombastic to be effective.

That’s true across a lot of modern reboots. The myriad Star Treks, for example, seem to feel the need to be action-packed movies instead of the idea-led potboilers of the past. I think producers think they need to do this to get past our shorter attention spans, but they’re missing the point: our quality filters are higher than they ever were, and the way to keep our attention is to give us tightly-written, compellingly-acted, humanistically-directed drama. Some of the best modern television - Succession, Severance, Slow Horses - do understand this, but clearly not everyone got the memo.

I’ll absolutely watch, probably multiple times, and I’ll probably love it. But I do wish we’d swap flash back for substance. Maybe I’m just getting old.

·

Posts

·

Werd I/O © Ben Werdmuller. The text (without images) of this site is licensed under CC BY-NC-SA 4.0.